Many couples today are paying for their own wedding, which makes it no great surprise that they would start their new life together in debt. Debt is that nasty four letter word that no one likes, we all fear and is hard to dig yourself out of unless you are prepared.

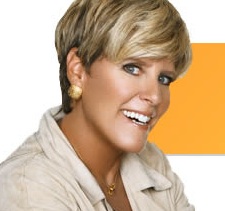

Not surprisingly, it is how you handle the debt that determines whether you will be a) successful at removing it and b) your marriage can weather the debt storm. According to financial guru, Suze Orman, money issues play a significant role in 90 percent of divorces.

Tips on managing debt from Suze Orman:

Budget – The purpose of a budget is to control your spending. Think of it as a diet for your bank account; you cannot charge more than you make or your debt will weigh you down. Be honest with each other about spending and never go over budget without giving the other person a heads up.

Joint accounts – Having a joint account to pay household bills is a good idea. But, each person should have their own separate account as well.

Equal Contribution – Each person should contribute the same percent of their income to the household. If you make $100,000 per year and your spouse makes $50,000 per year, your contribution will be double. Percent is the key word. If you don’t make equal money, you can’t contribute the exact same dollar amount.

Control – You should always be allowed to control your own money. If your spouse insists that you relinquish all of your money into a joint account and you have to ask for money, this is a recipe for disaster.

In most relationships, there is one person who is a spender and one is a saver. If you can combine your strengths and weaknesses for the greater good, this is a terrific combination. If you are both spenders, you should seek financial guidance early in your relationship so you don’t become a statistic.

-Penny Frulla for Bridal Expo Chicago